Cauri

Key Data

- Trading Name: Cauri

- Legal Entity: Cauri Ltd

- Activities: Small Payment Institution

- Location: London, UK

- Regulations: authorized by the Financial Conduct Authority (FCA)

- Key People: Nikolai Ionkin, Aleksandrs Stepanovs, Alexander Afanasov

Cauri is the trading style of Cauri Ltd, licensed in the UK by the FCA as a payment provider.

According to the UK Companies House, Cauri is controlled by Latvian Aleksandrs Stepanovs and the Cyprus-registered E.D.M.S. Trading Limited. In addition to Stepanovs, the two Russians, Alexander Afanasov and Nikolai Ionkin, are also on its board.

One of the company’s agents is the FCA-registered Moneytea Ltd doing business as Mercuryo (see profile).

Offering

Cauri.com is a website and financial services provider that offers mass and single payments in multiple currencies to bank cards, electronic wallets, and mobile phone accounts. The platform allows merchants to accept payments from clients worldwide using a range of preferred bank cards and e-wallets.

In addition, Cauri.com has developed a suite of solutions for TSPs (telecommunications service providers) and financial projects that includes tools for conducting payment-related business in the UK. The company’s offerings are designed to provide fast, secure, and reliable payment processing services that meet the needs of businesses of all sizes.

There service includes:

- Payments in more than 32 currencies from various countries

- Mass payments

- PAYMENTS TO INDIVIDUALS

- ARRANGING RECEIPT OF PAYMENT

- Payments between individuals within the framework of regular or cryptocurrency projects

Pricing

Cauri.com offers transparent pricing plans for their payment processing services. The pricing plans vary based on the type of card used and where it was issued.

- For cards issued within EU countries, the rate is 3% + 0.1 EUR/GBP, while for cards issued outside the EU, the rate is 3.5% + 0.1 EUR/GBP.

- Rolling reserve is set at 10% for 180 days. Refunds and compensation cost 0.6 EUR/GBP each.

- Chargebacks, chargeback processing, and payouts all cost 45 EUR/GBP. Payouts to mobile phones are charged at a rate of 2%.

- The fixed share of commission may differ based on the nature of the business. If individual circumstances require a different pricing plan, customers can contact Cauri.com to work out a solution.

Compliance Problems

FinTelegram has discovered FCA-regulated payment institution Cauri Ltd d/b/a Cauri as a payment processor in various broker scams in recent years.

Russian Connections

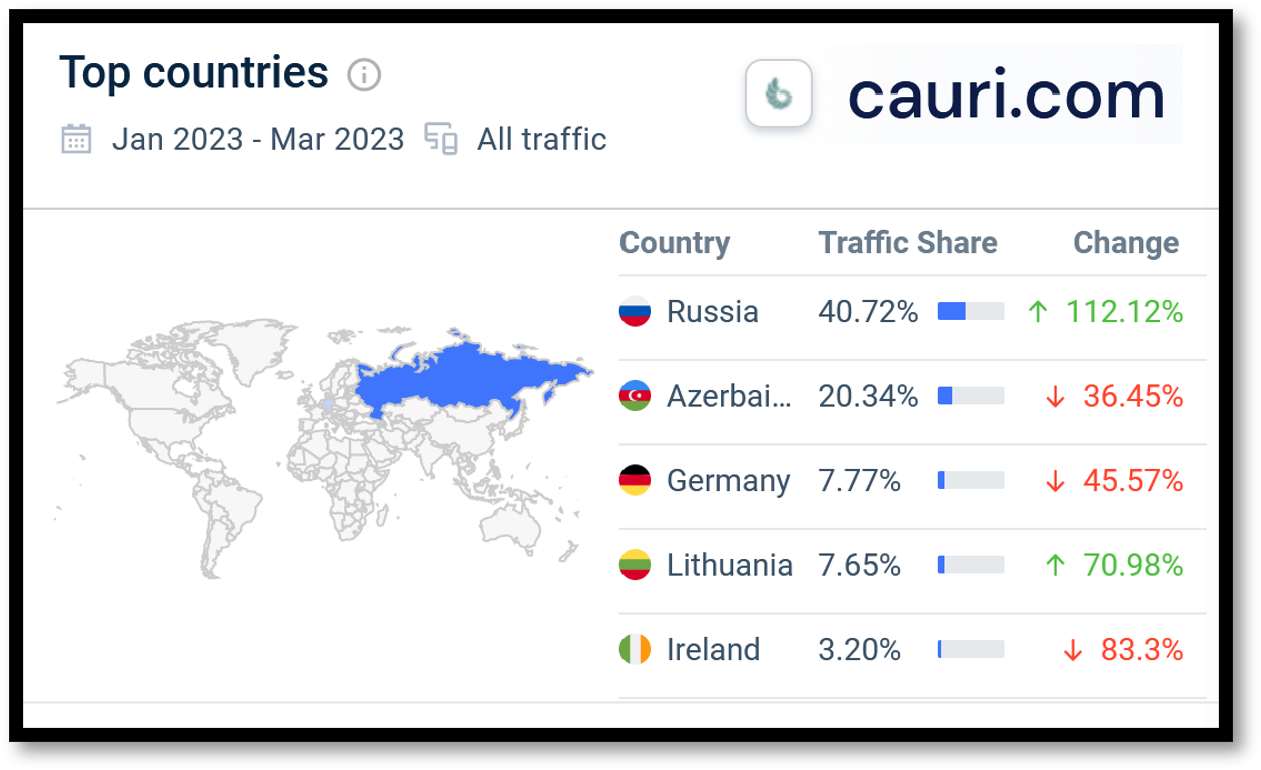

The FCA restricted Cauri from providing payment services to Russian citizens or legal entities in January 2023. Since then, traffic to the Cauri website has plummeted, but over 40% of its website visitors came from Russia in Q1 2023.

In its restrictions, the FCA said that Cauri must not register, on-board, or provide payment services (either directly or via outsourced partners) to any person categorized as high-risk for the purposes of financial crime risk.

The reason for these restrictions is probably that the FCA has noticed corresponding Russian transactions at Cauri. Of course, these restrictions also apply to Cauri‘s agents, the UK-registered MoneyTea Ltd d/b/a Mercuryo, and Tranzap Ltd d/n/a Transbase.

Perhaps because of these FCA restrictions for Cauri, Mercuryo Group may have decided to take control of FCA-registered EMI Monetley in February 2023 (see report here).

Conclusion

Due to her involvement in various scams, her connection to Mercuryo and her cooperation with sanctioned russians, we put Cauri on red.