Treezor

Key Data

- Trading Name: Treezor

- Legal Entity: TREEZOR SAS

- Activities: White label solutions

- Location: Paris, France

- Regulations: electronic money institution license by the Autorité de Contrôle Prudentiel et de Résolution (ACPR)

- Key People: Founder Éric Lassus and Xavier Labouret

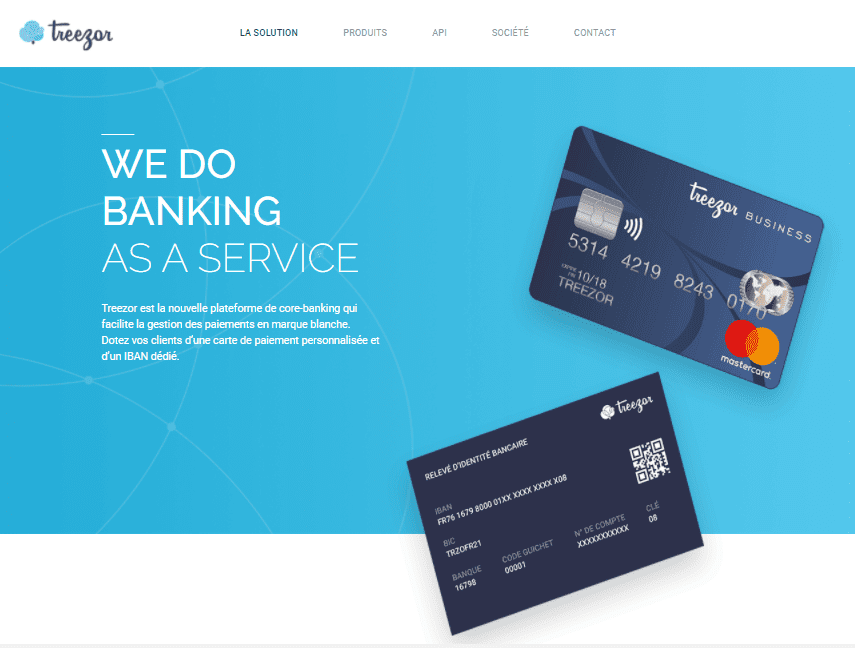

Treezor is an independent provider of outsourcing and white label solutions for electronic payments.

Founded in 2016 by Éric Lassus and Xavier Labouret, acquired in 2019 by the Societe Generale group.

TREEZOR has been granted an electronic money institution license by the Autorité de Contrôle Prudentiel et de Résolution (ACPR) and is authorized to provide the payment services provided.

Offering

As a ” one-stop-shop payment solution,” Treezor is an API-based white-label core banking platform that enables both the receipt and issuance of payments and covers the entire payments space.

The company facilitates payment management by enabling its more than 100 licensed and unlicensed fintech clients – including neobanks, professional banks and marketplaces – to offer their customers personalized payment services such as:

Wire transfers, peer-to-peer (P2P) transfers, account management, digital wallets, check acquisition, as well as physical and virtual prepaid, debit and credit cards, and dedicated international bank account numbers (IBANs).

Treezor operates in 25 countries as a Payment and Electronic Money Institution and also a key member of international card networks.

Some of Treezor’s fintech clients include:

- Lydia

- Qonto

- Lunchr

- Shine

- Upflow

- Xaalys

The company scores very poorly on Trustpilot with just 2 stars.

Conclusion

Due to the rather dissatisfied customers we rate Treezor in our “Orange Compliance” list.