MoneyNetint

Key Data

- Trading Name: MoneyNetInt

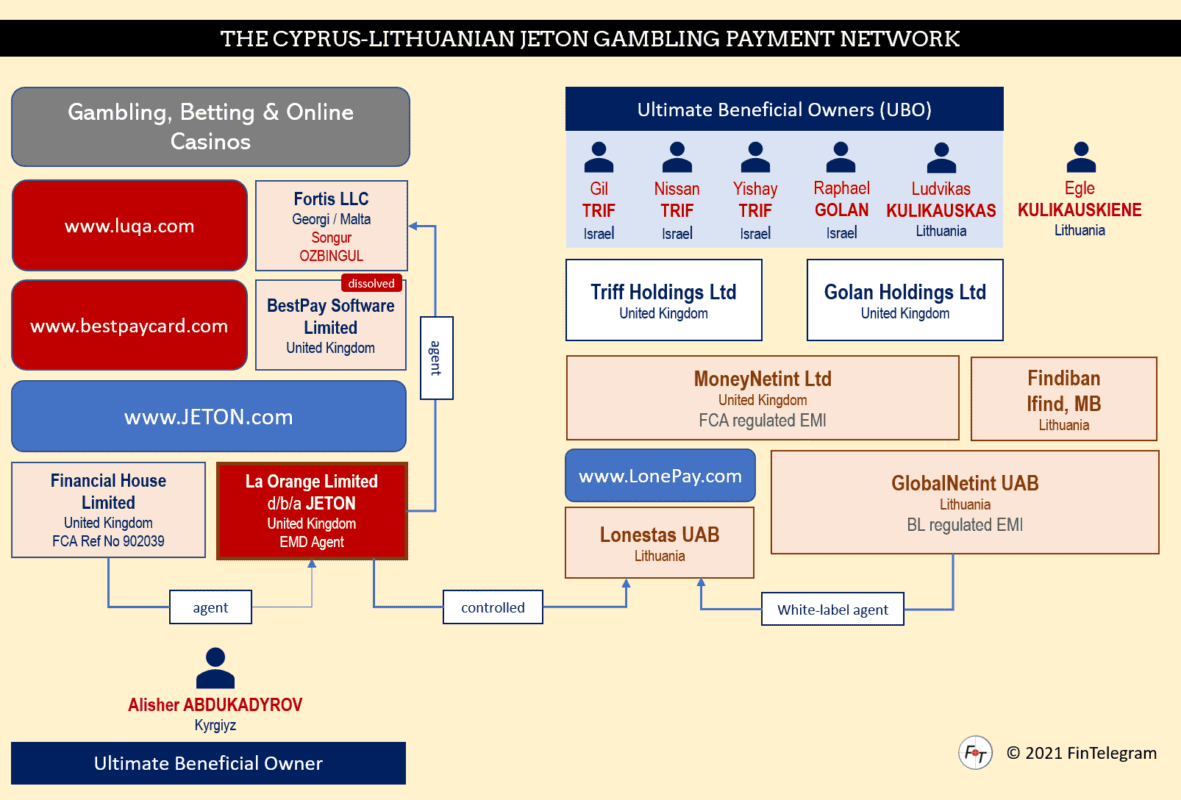

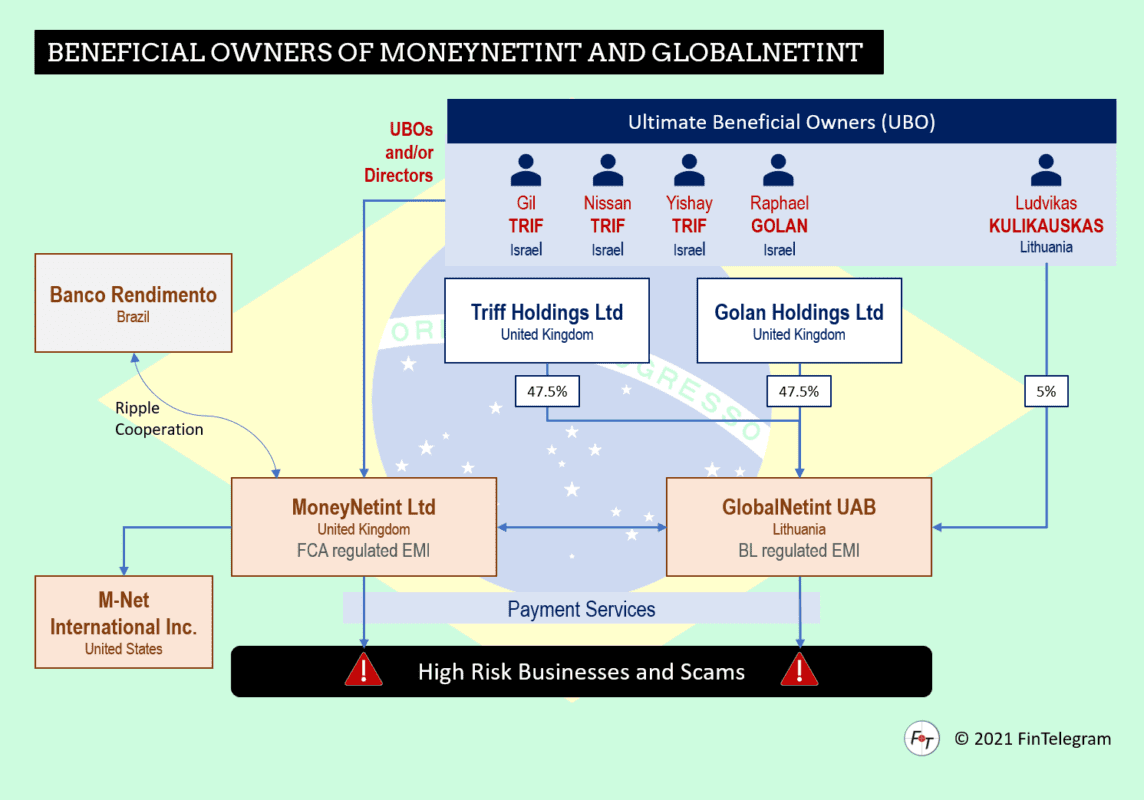

- Legal Entity: MoneyNetInt Ltd/Golan Holdings Ltd/Triff Holdings Ltd

- Activities: International payment services.

- Location: London, UK

- Regulations: authorized by the Financial Conduct Authority (FCA)

- Key People: Raphael Golan, UK

Leon Isaacs, UK

Gil Trif, Israel

Nissan Trif, Israel

Yishay-Moshe Trif, Israel

Ludvikas Kulikauskas, Lithuania (LinkedIn)

MoneyNetInt is an FCA-regulated e-Money Institution (EMI) focused on providing international payment services.

It is controlled by the four Israelis Raphael Golan, Gil Trif, Nissan Trif, and Yishai Trif. Since 2017, the MoneyNetint Group has been operating GlobalNetInt UAB s/b/a payswix (PR42 profile) in Lithuania, authorized by the Bank of Lithuania as EMI, together with local partner Luidvikas Kulikauskas.

MoneyNetInt began in 2003 as a small family business with a few ATMs and a small number of employees. In 2004, the company expanded internationally and has since grown into a global provider that conducts billions of dollars in transactions annually.

It offers:

business IBAN accounts, personal IBAN accounts, debit cards, SEPA payments, multi-currency e-wallet management, credit card processing, and merchants’ payment solutions.

The company is an important strategic partner of Ripple.

News

The MoneyNetint Group is also connected to the Vienna Cybercrime Trials around the convicted scammer Gal Barak. Via MoneyNetint Group Barak laundered money to Online Prospect and DYISY Group of Simon Tetroashvili, for example.

MoneyNetInt evidently had some troublesome communication with the UK Financial Conduct Authority (FCA) in early 2021. Since mid-2021, the website informs that “effective from 1 June 2021, Moneynetint Limited (FRN: 900190) volunteered to: restrict, for a temporary period, the onboarding of all new customers as part of an enhancement process, following dialogue with the Financial Conduct Authority (FCA). Existing customers should not be affected during this temporary period, and all of our services remain intact.“

Until at least Q3 2021, the shareholders of FCA-regulated MoneyNetInt, Golan Holdings Ltd and Triff Holdings Ltd, were also the majority shareholders of GlobalNetInt UAB (now Payswix UAB) in Lithuania. While MoneyNetInt had to restrict its onboarding of new clients after discussions with the FCA, this Lithuanian EMI had money laundering problems and was fined €350,000 by the Bank of Lithuania.

As of 2017, binary options were banned in most regulatory regimes. Since then, MoneyNetInt‘s business might not be doing so well either, as their latest figures suggest. Here is an update.

Conclusion

Due to its deep involvement in broker scams as a payment processor, we included MoneyNetint in our “Red Compliance” list.