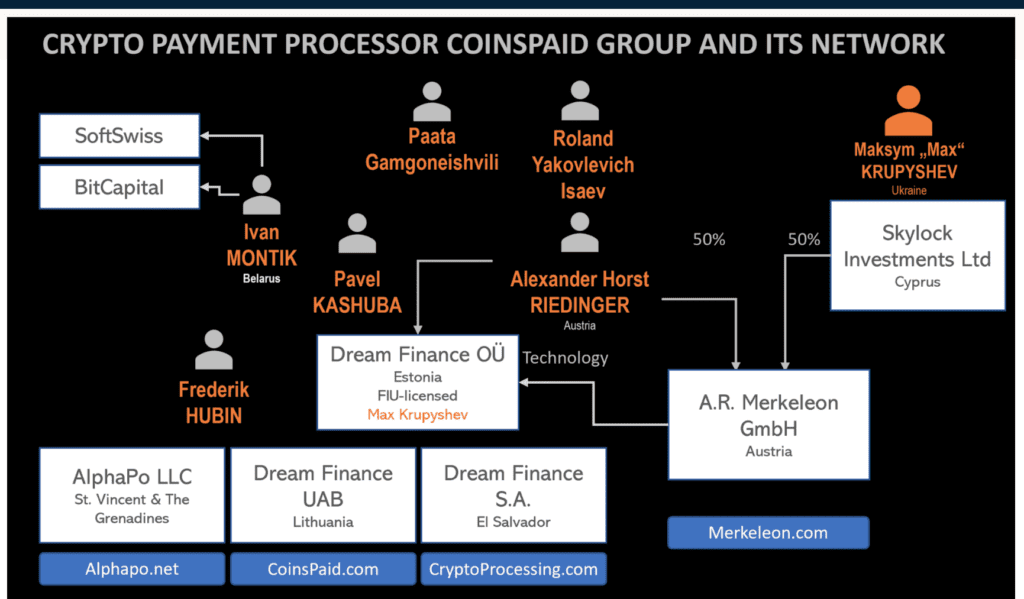

The CoinsPaid operates through a number of legal entities in different jurisdictions. The official beneficial owners are the Austrian Alexander Horst Riedinger and the Ukrainian Max Krupyshev. Most recently, its CryptoProcessing reported that it had processed €2.230 billion in Q3 2024 as the leading crypto payment processor. The CoinsPaid group is at the center of serious accusations that are anonymously made on the web.

1. Overview of CoinsPaid and CryptoProcessing Operations

CoinsPaid, a prominent crypto payment processor, operates through various legal entities across jurisdictions, including Estonia, Lithuania, and El Salvador. The group also manages CryptoProcessing, its primary crypto payment platform, handling substantial transaction volumes in high-risk industries, such as iGaming and gambling.

In its recent Q3 2024 report, CryptoProcessing announced an impressive turnover of €2.23 billion, marking a 27% increase from Q3 2023, with over 2.52 million transactions processed. Hanna Drabysheuskaya, CFO of CryptoProcessing, emphasized that crypto’s lower transaction fees, enhanced speed, and cross-border accessibility are driving its adoption among businesses globally.

2. Corporate Structure and Ownership

Key Figures and Ownership Details:

- Alexander Horst Riedinger (Austria): The official main shareholder through his Austrian software company A.R. Merkeleon GmbH.

- Max Krupyshev (Ukraine): CEO of CoinsPaid, holding an interest via Skylock Investments Ltd in Cyprus. Known as a crypto influencer, Krupyshev’s public role is central to CoinsPaid’s corporate strategy.

- Ivan Montik (Belarus): Alleged co-founder and influential figure within CoinsPaid, Montik is the founder of SoftSwiss, another prominent provider in crypto and iGaming technology.

In addition, CoinsPaid is reported to have connections to the Georgian-born Russian billionaire Paata Gamgoneishvili and his business associate Roland Yakovlevich Isaev. These individuals are allegedly linked to CoinsPaid’s network through SoftSwiss, with various online sources and anonymous reports suggesting their involvement in international money laundering for Russian interests.

Read FinTelegram’s CoinsPaid reports here.

3. Recent Hacking Incidents and Financial Integrity Concerns

CoinsPaid has recently been subjected to two major hacking events:

- January 5, 2024: A cyberattack led to a $7.5 million loss in crypto assets.

- July 22, 2023: A second, more severe attack resulted in losses of approximately $37.3 million, reportedly orchestrated by the North Korean Lazarus Group using advanced social engineering tactics.

Despite the substantial financial impact, CoinsPaid assured clients that funds remained protected. The company’s financial stability, however, is under scrutiny due to a suspected negative equity position. Critics suggest that these hacking incidents may reflect deeper liquidity and solvency challenges within CoinsPaid, potentially exacerbated by extensive operational risk exposure.

4. Allegations of Financial Misconduct and Regulatory Evasion

The group has come under increasing scrutiny following a series of anonymous accusations on social media platforms such as X (formerly Twitter) and websites like CoinsPaidScam.com. Allegations have largely centered on:

A. Financial Misconduct and Bankruptcy Concerns

CoinsPaid’s $37 million loss has spurred suspicions about its financial health, with critics suggesting a hidden insolvency. Discrepancies in reported losses have raised questions about potential undisclosed liabilities or mismanagement.

B. Money Laundering Operations

Reportedly, CoinsPaid facilitates substantial money laundering activity for offshore gambling entities, primarily through networks involving Belarusian expatriates and other Eastern European connections. Anonymous reports describe an operational model that allegedly enables the movement of hundreds of millions of euros annually, exploiting lenient regulatory environments.

C. Shadow Stakeholders and Management

CEO Max Krupyshev is portrayed as a figurehead, with real control residing among Belarusian interests. Allegations suggest a strategic use of corporate structures and nominee owners to veil true ownership, with Belarusian figures exerting significant influence. Notably, Paata Gamgoneishvili and Roland Yakovlevich Isaev are implicated as silent stakeholders, allegedly aiding in evading international sanctions through these channels.

5. The AlphaPo Connection

A significant aspect of the CoinsPaid narrative is its alleged connection to AlphaPo, another crypto payment processor. Investigative sources, including Shana Dovi’s report (report here), have indicated operational and managerial overlaps that imply AlphaPo and CoinsPaidoperate as a single entity. Key points include:

- Shared Technology and Compliance Departments: CoinsPaid and AlphaPo reportedly share IT infrastructure and compliance operations, indicating an uncharacteristically integrated operation.

- Simultaneous Security Breaches: Both companies reportedly suffered identical cyberattacks in July 2023, further suggesting interconnected systems and oversight.

- Financial and Personnel Overlaps: Transactions between CoinsPaid and AlphaPo allegedly occur without formal accountability, with shared Slack channels for operational decisions on client onboarding. These overlaps point to a unified financial strategy, potentially designed to obscure regulatory oversight.

In May 2024, the self-proclaimed crypto investigator Shana Dovi posted a series of tweets on Xin which she published the results of an investigation into CoinsPaid and CryptoProcessing. She published the full report on the Medium platform. Meanwhile, Shana Dovi’s account on Medium is under investigation for violating Medium’s rules. We cannot say whether this is an indication that the report was false. We know from our own experience that CoinsPaid takes aggressive action against critical reporting. It is likely that CoinsPaid complained to Medium about Shana Dovi.

Ivan Montik and SoftSwiss are represented by the law firm REVERA, based in Belarus and Cyprus. One of the partners in that firm, Helen Mourashko, is married to Pavel Kashuba, CFO at SoftSwiss.

6. Online Accusations and Reputation Challenges

Various websites and social media profiles, including CoinsPaidScam.com, Global Economy Edition, and anonymous social media accounts, have emerged as vocal critics of CoinsPaid’s alleged misconduct. In addition, Global Economy Edition published an exposé linking CoinsPaid to Georgian-born Russian billionaire Paata Gamgoneishvili and Roland Yakovlevich Isaev, asserting that both figures aid in money transfers circumventing sanctions against Russian interests.

These accusations draw from previous investigative reports, including those from Bigol, a Bulgarian investigative platform, which connected Gamgoneishvili and Isaev to Russian organized crime. Allegedly, they use a network of payment processors and front companies to maintain capital flows for oligarchs affected by international sanctions.

7. Conclusion

CoinsPaid’s rapid growth and sizable transaction volumes in high-risk sectors mark it as a significant player within the crypto industry. However, the complex allegations of financial misconduct, regulatory evasion, and shadow ownership signal potential vulnerabilities that warrant regulatory attention. CoinsPaid’s associations with known Eastern European billionaires, alleged involvement in money laundering, and documented hacking incidents place its operations within a high-risk category.

In the evolving regulatory landscape, this report serves as a foundational document for compliance officers and law enforcement entities to examine the critical elements of CoinsPaid’s operations. Thorough investigation into the accusations, paired with coordinated regulatory efforts, will be essential to uphold financial integrity and mitigate potential systemic risks.

Key Data CoinsPaid

| Trading names | CoinsPaid CryptoProcessing AlphaPo |

| Business activity | Crypto exchange & OTC desk operator High-Risk crypto payment processor |

| Domains | https://cryptoprocessing.com https://coinspaid.com https://alphapo.net |

| Social media | LinkedIn, Facebook, Instagram, |

| Legal entities | Dream Finance OÜ (Estonia) Dream Finance UAB (Lithuania) Dream Finance S.A. (El Salvador) A.R. Merkeleon GmbH (AT) Skylock Investments Ltd (CY) |

| Jurisdictions | Estonia, Austria, Cyprus, El Salvador, St. Vincent & The Grenadines |

| Authorization | FIU crypto license no FVT000166 |

| Related individuals | Alexander Horst Riedinger, Austria (LinkedIn) Ivan Montik (personal website) Pavel Kashuba Maksym Krupyshev, Ukraine (LinkedIn) Andrei Koposov, Georgia (LinkedIn) Frédéric Georges Hubin Svetlana Prussova Violaine Champetier de Ribes Christofle Hanna Drabysheuskaya Aliaksei Kuzniatsou Maria Akulenko Paata Gamgoneishvili Roland Yakovlevich Isaev |

| PayRate42 rating | Orange Compliance (profile) |